Is Now the Right Time to Finally Go Short on Oil Futures?

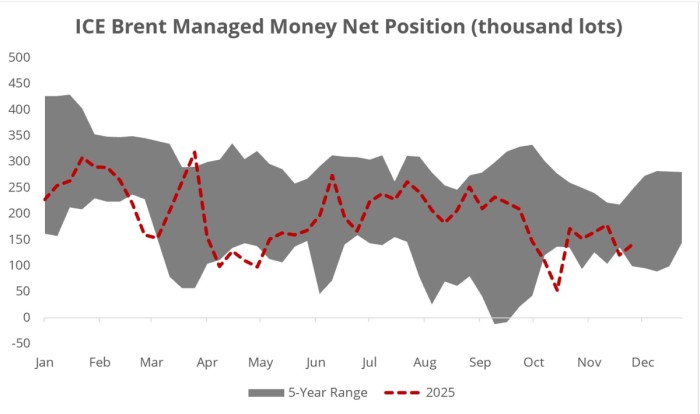

– Behind the façade of calm oil markets, a gradual build-up in speculative positions could be undermining future prices of Brent or WTI as both benchmarks remain on their longest runs below their 100-day moving average in more than a year.

– Open interest held in ICE Brent is now the highest in history – 5.5 million contracts as of this week – however investors hold more Dec 2026 contracts than any other month except for the prompt two, February and March, suggesting that the market wants to hedge itself against oversupply next year.

– The risk is that a brief geopolitical event – such as a potential Ukraine peace deal – could suddenly prompt market participants to fully embrace their inner bear.

– Hedge funds have been raising their short positions on crude for the past two months, with ICE Brent now posting the highest outright number of shorts on record (174,703 contracts in the week ending December 2).

– CFTC is still taking its time publishing WTI positioning data that was delayed due to the US government shutdown; however recently published October data show that throughout the month hedge funds held a net negative position.

Market Movers

– Presenting its new 5-year plan, US oil firm ExxonMobil (NYSE:XOM) raised its 2030 production guidance by 100,000 b/d to 5.5 million boe/d, revising upwards its Permian Basin supply.

– Norway’s state oil company Equinor (NYSE:EQNR) announced two new gas and condensate discoveries in the North Sea, potentially containing up to 110 million barrels of oil equivalent.

– Trading giant Vitol is reported to land a deal with Colombia to supply the Latin American country’s new gas import terminal in Barranquilla, with the contract running for 5 years starting from 2027.

– US oil major Chevron (NYSE:CVX) announced it would participate in Nigeria’s upcoming licensing round (offering 50 prospective blocks) and it would deploy a drilling rig there in 2026 as it plans to boost its West African exploration activity.

– US gas-focused producer Antero Resources (NYSE:AR) said it would buy the producing gas assets of privately held HG Energy in a deal valued at $2.8 billion, boosting its portfolio across the Appalachian Basin.

Tuesday, December 09, 2025

Oil prices continue to search for direction as a supply scare from Iraq turned out to be short-lived, with most market speculation centred around Ukraine peace talks and US Federal Reserve policy. With ICE Brent still hovering around $63 per barrel, the Fed’s last gathering in 2025 could provide some temporary upside to prices, however it is unlikely to fundamentally break the current stalemate.

EU Buckles Under US and Qatari Pressure. The European Union agreed to scale back its corporate sustainability laws after both the United States and Qatar threatened to halt energy exports in case its CSDDD rules aren’t eased, however US firms complained that changes ‘didn’t go far enough’.

G7 to Finally Bury Failed Price Cap Action. G7 countries and the European Union are reportedly in talks to replace their December 2022 price cap on Russian oil exports, having failed to restrict flows to India and China even after it was lowered to $47.60 per barrel, with a full maritime services ban.

Chinese Oil Imports Continue to Soar. China’s crude oil imports soared to their highest since August 2023 last month, according to the country’s Administration of Customs, with Chinese refiners taking in 12.38 million b/d, up 5% month-over-month on higher flows of Iranian and Russian crude.

Congo Tightens Cobalt Export Rules. The government of Congo has set new conditions for cobalt exporters, tightening its 96,000 tonne per year quota system with requirements to pre-pay 10% of royalty fees within 48 hours of filling their export declarations and receiving a compliance certificate.

Indians Splash the Cash on Russian Oil. Indian state-owned refiners have ramped up their purchases of Russian crude, with Indian Oil Corp and Bharat Petroleum buying up to 10 January-arrival cargoes last week, benefitting from lower delivered prices as Urals now trades $6 per barrel below Brent.

Brazil Zooms in on Exploration. Brazil’s national oil firm Petrobras (NYSE:PBR) has cut its 5-year spending plan by $2 billion to $109 billion but raised its exploration budget by $1 billion to a total of $78 billion, aiming to reach 2.7 million b/d in oil output by 2028, up 10% from now.

EU Plans Major Power Grid Overhaul. The European Union is reportedly preparing a major push to improve cross-border grid connections, warning of billions lost from bottlenecks and failures to meet power demand with supply as Brussels intends to double down on its 2050 net zero target.

Libya Prepares for Key Gas Wildcat. Italy’s ENI (BIT:ENI) and UK oil major BP (NYSE:BP) plan to drill Libya’s most-anticipated deepwater exploration well in Q1 2026, expecting that the Sirte Basin’s gas reserves extend offshore as Tripoli aims to boost gas output to 4 Bcf/d by end-decade.

EIA Vows to Cut Down on Unnecessary Reports. Tristan Abbey, the administrator of the US Energy Information Administration (lost 100 of its 350 full-time staff), pledged to work ‘aggressively’ to revise EIA reports with redundant information, saying the agency now publishes ‘too many reports’.

India’s Coal Romance Is Far from Over. India is considering a major expansion in coal power capacity with plans to build new plants until at least 2047, a policy change compared to previous projections peaking by 2035, with Delhi potentially adding 420 GW of new capacity, a 87% increase from now.

Baghdad Shutters Key Oil Asset. Iraq shut down production for a day at the West Qurna-2 oil field operated by Russian firm Lukoil (MCX:LKOH) due to a reported leak in the pipeline connecting it to the port of Basrah, temporarily halting some 460,000 b/d of output or 0.5% of global oil supply.

Struggling to Survive, UK Drillers Unite. Less than a month after Shell and Equinor merged their UK North Sea assets, the French and Spanish oil majors TotalEnergies (NYSE: TTE) and Repsol (BME:REP) announced they would merge their assets under NEO NEXT+, producing some 250,000 boe/d.

Indonesia Boosts Gas Reserves with New Find. Italian oil major ENI (BIT:ENI) has reported a huge natural gas discovery offshore Indonesia, some 30 miles off the coast of East Kalimantan, with its Konta-1 exploration well confirming commercial reserves of more than 600 BCf.

US Court Rejects Trump Wind Energy Ban. A US District Judge ruled that the Trump administration’s move to halt federal approvals for new wind energy projects was ‘unlawful and arbitrary’, failing to provide adequate reasoning for why the 1946 Administrative Procedure Act couldn’t be followed.

#Hedge #funds #position #price #crash #Brent #shorts #hit #alltime #high

Leave a Reply