“The stock market is a device to transfer money from the impatient to the patient”- Warren Buffett

A few weeks ago, I met an old friend at an event, and the conversation we had that day has been lingering in my mind ever since.

My friend reflected on how she only got to know about investment opportunities after attending a Financial Literacy Seminar two years ago, despite operating a savings account for several years.

She recounted the day she entered a bank in Accra, curious about opening her first savings account. She was young and eager to start managing her finances.

According to her, the bank representative greeted her warmly and asked how she could assist her. She expressed her desire to start saving, not knowing there were several options like Treasury Bills, Bonds, and others that she could have considered in the future.

She noted that the staff recommended a type of savings account that could earn her a decent interest rate, which made her excited to start her savings journey, and she quickly agreed.

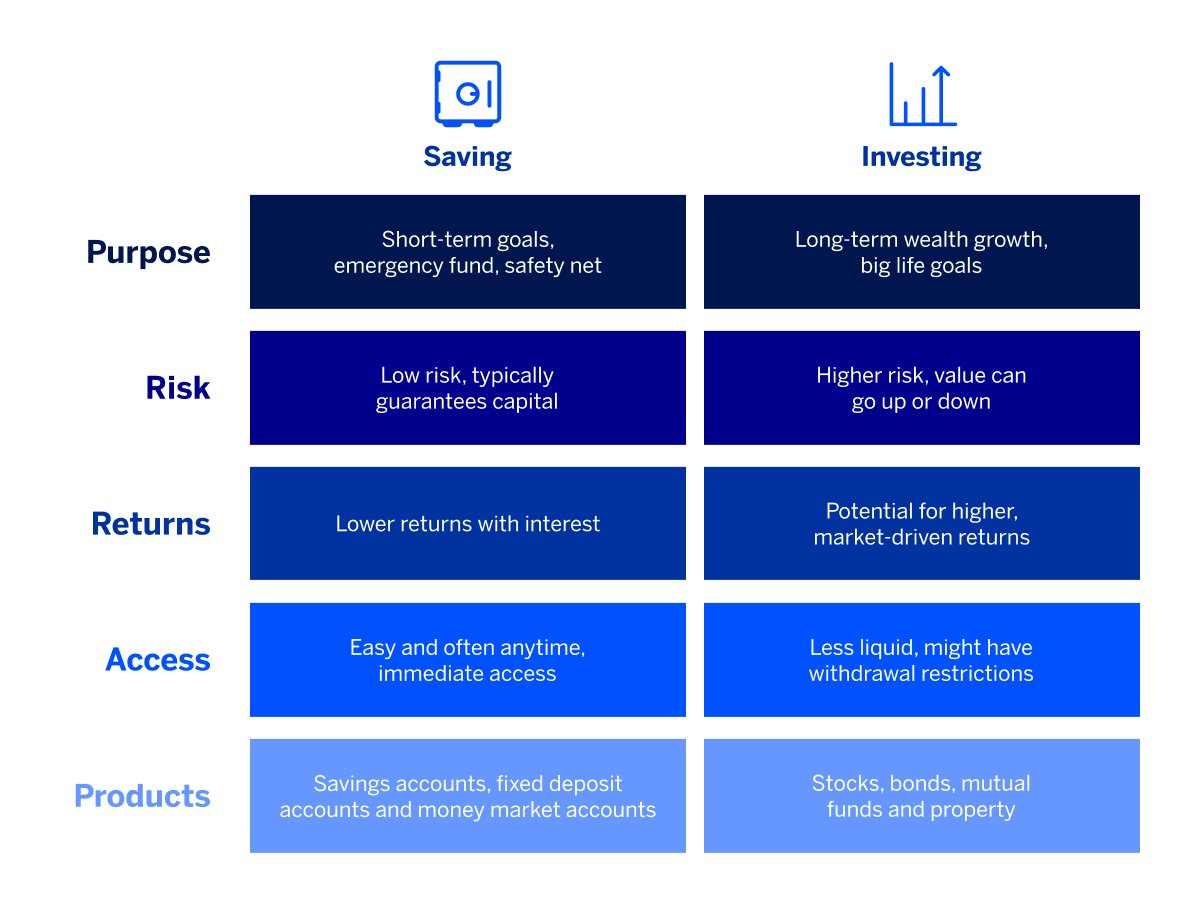

It wasn’t until much later, when she began reading more about personal finance, that she realised she had been introduced to a savings account rather than an investment account. At the time, she didn’t know the difference and wondered why she wasn’t introduced to such options the first time she walked into the bank to open an account.

My friend is not the only victim of this financial ignorance. Indeed, there are several young men and women out there who do not know much about any investment opportunities they can explore as they continue to make wealth in their businesses.

As I reflect on the conversation I had with my friend, I’m reminded that not knowing something at the beginning shouldn’t hold you back from pursuing your financial goals.

The Importance of Financial Literacy

Financial literacy is crucial in making informed decisions about our money. It empowers us to take control of our financial future, make smart investments, and achieve our goals. Unfortunately, many Ghanaians lack access to financial education, making it challenging to navigate the complex world of investing.

This lack of financial inclusion and investment is a significant concern, as it can impact individuals’ ability to achieve financial stability and security.

However, it’s not all doom and gloom. There are many initiatives underway to improve financial literacy in Ghana, including programs aimed at educating people about investing and personal finance. These efforts are crucial in empowering individuals to make informed decisions about their money and take control of their financial future.

Investment Options in Ghana

There are several investment options available in this country that you can consider. Some of these investment options include:

1. Stocks: Invest in Ghanaian companies listed on the Ghana Stock Exchange.

2. Bonds: Government and corporate bonds offer a relatively stable investment option.

3. Mutual Funds: Mutual funds provide investors with an easy way to diversify their portfolio and reduce risks, as the fund can be invested in many different stocks or bonds.

4. Real Estate: Invest in property, either directly or through a real estate investment trust (REIT).

5. Treasury Bills: Short-term government securities offer a low-risk investment option.

You can freely walk into any bank and make further inquiries about the investment options available.

Overcoming Fear and Uncertainty

Fear and uncertainty are common barriers to investing. Many people fear losing money or making mistakes. Others may feel uncertain about the process or lack the confidence to get started.

The key is to acknowledge these fears and take the first step. Educate yourself, seek advice, and start small.

Remember, investing is a journey, and it’s okay to make mistakes. The sooner you start, the sooner you will begin to see the benefits of compound interest and the power of your money working for you.

Conclusion

It is never too late to start taking control of your financial future, educating yourself, and exploring investment options. The journey may seem daunting, but with persistence and patience, you can achieve financial stability and security.

#Living #Late

Leave a Reply