| Image: Google |

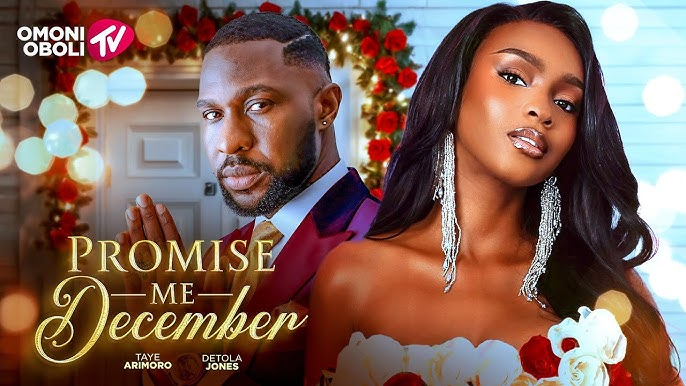

For many Nigerians, December is more than a month—it’s a lifestyle. From endless parties and social events to last-minute trips and outfit upgrades, Detty December comes with a level of excitement that’s hard to resist. The atmosphere is electric, and saying “no” often feels like missing out.

However, once the celebrations fade, reality sets in. January arrives with rent, bills, transport costs, and other responsibilities, while many people are left wondering where all their money went. Enjoying the festive season doesn’t have to mean financial regret. With intentional choices, you can celebrate fully and still protect your finances.

Start With a Spending Blueprint

Before December activities pick up, it’s important to understand what you can realistically afford. Take a moment to review your income, savings, and obligations. Then outline likely expenses such as outings, travel, gifts, food, transportation, and miscellaneous costs.

Creating a spending plan gives you direction. It helps you decide which events to attend and which ones to skip without guilt. Leaving room for unexpected expenses also prevents panic spending later in the month.

Spend With Purpose, Not Pressure

December spending is often driven by comparison and social expectations. Whether it’s gift-giving or showing up in style, pressure can push people to spend beyond their means. Instead of buying impulsively, decide early who you’ll exchange gifts with and how much you’re willing to spend.

Thoughtful doesn’t have to mean expensive. Small but intentional gestures like handwritten notes, customized items, or shared experiences often hold more value than pricey presents. You can also suggest group gift exchanges to reduce costs while keeping the festive spirit alive.

Keep an Eye on Your Daily Spending

One of the easiest ways money disappears in December is through small, repeated expenses. Transport fares, snacks, drinks, and quick purchases may seem harmless but add up quickly.

Tracking your spending daily—whether through an app or a simple note—helps you stay aware. When you know exactly where your money is going, it becomes easier to adjust your habits before things get out of control.

Guard Your Savings Fiercely

Savings are not part of your December entertainment budget. Before the festivities begin, make sure essential funds for rent, utilities, school fees, and other commitments are untouched.

Using savings for short-term enjoyment may feel harmless, but it often creates stress later. Keeping your safety net intact ensures that January doesn’t start on a difficult note.

Build Rest Days Into Your Calendar

Not every day needs to involve spending money. Scheduling intentional rest or stay-at-home days can significantly reduce costs. These days can be spent cooking, catching up on movies, bonding with family, or simply recharging.

Balancing high-spending days with low-cost ones helps maintain financial stability while preventing burnout from constant outings.

Choose Joy, Not Just Luxury

Fun doesn’t always come with a high price tag. Some of the most memorable moments happen at house parties, game nights, beach walks, picnics, or free events.

By focusing on meaningful experiences rather than expensive venues, you can still enjoy December without stretching your finances. The memories remain, even when the spending is minimal.

Think Beyond December

While December is festive, January is practical. Preparing ahead makes all the difference. Set aside money early for post-holiday expenses like transportation, subscriptions, and daily needs.

If you receive extra income or bonuses, avoid spending everything immediately. Saving a portion ensures a smoother transition into the new year.

Enjoy December Without the Regret

Detty December should be about connection, laughter, and celebration—not anxiety about money. With clear planning, mindful spending, and realistic choices, it’s possible to enjoy the season fully and still enter the new year with confidence.

Celebration and financial responsibility can coexist. When done right, December remains vibrant, memorable, and stress-free—without your bank account paying the price.

#DettyDecember

#NollywoodTimes

#TrendingNow

Leave a Reply